Investing can feel like a daunting venture, especially for beginners seeking to build wealth or secure a financial future for themselves and their families. With a plethora of investment options out there, and a stream of what often seems like conflicting advice, where might you start?

This blog aims to guide new investors and professionals like you who are thinking about taking the financial plunge into the intricate world of investing. Read on for five established investment consulting strategies we believe will help set you on the right course.

Introduction

At Iron Point, we believe investment consulting is more than just a trend or an add-on; we see it as an essential companion for guiding novices through the complicated labyrinth of trading, saving, and allocating investment resources. This first section explores why consulting has become an essential part of the investment landscape, how beginners can benefit from it, and what they stand to gain from these strategies.

Investors who decide to leverage the advice of seasoned consultants can open the door to a world of tailored strategy, healthy risk management, and comprehensive financial planning. As a beginner, knowing where to begin or how to shift your current tactics can make all the difference in the long-term success of your investment journey.

Investment Consulting Strategy #1: Understand Your Risk Tolerance

We believe the cornerstone of any successful investment strategy is understanding your personal risk tolerance. “Risk tolerance” refers to an investor’s psychological ability to endure the possibility of financial loss.

This unique investor preference is influenced by a variety of factors, including your age, income level, investment goals, and overall investment time horizon (how long you plan to invest your assets for).

You determine your risk tolerance by thinking through the impact hypothetical financial losses could have on each of these factors, and determining whether you feel comfortable with and able to “take the hit” if individual investments don’t work out in the short- or medium-term.

There are many free online tools and questionnaires that can provide you with a structured approach to this introspective process. These range from simple tick-box quizzes to more complex algorithms that measure reactions to fiscal scenarios. The goal of these tools is to help produce a balanced portfolio that aligns with your risk appetite and investment goals, avoiding the extremes of either overly cautious or overly aggressive investments. Iron Point Financial offers this kind of tool to its clients for precisely this reason.*

If you develop a well-reasoned understanding of your risk tolerance in this way, you can steer clear of investment decisions that carry more risk than your unique circumstances can safely allow for. In other words, knowing your risk tolerance can give you a buffer against impulsive and potentially damaging investment choices, and set you up with the best long-term strategy for success.

*Disclosure: Advisory services may only be offered by Investment Adviser Representatives in connection with an appropriate Cetera Advisor Networks LLC Advisory Services Agreement and disclosure brochure as provided. The output of any financial tool or calculator without such an agreement should be considered to be part of our brokerage services and not advisory services.

Investment Consulting Strategy #2: Set Clear Financial Goals

When it comes to investing what matters, it’s so, so important for you to set clear financial goals. The way you spend and invest your money and other assets is a direct reflection of your values and principles, so clarity over what you are aiming for should be paramount. You are not just dealing with abstract “things” but the substance of what makes life worth living.

In this arena, think of goals as a “roadmap” for your investment strategy. Without a sense of direction, you could end up anywhere — but with a well-marked, easy-to-read map, you can measure how close you are to key markers of progress and to your ultimate, desired destination.

We recommend thinking of these objectives in S.M.A.R.T. terms:

- S: Specific

- M: Measurable

- A: Achievable

- R: Relevant

- T: Time-bound

An example of longer-term objectives might include proactive retirement planning or even legacy planning, while shorter-term goals could look like a down payment on your first home or meeting an investment aim for your son or daughter’s college fund.

Maintaining an awareness of these goals will not only help align your investment strategy, but can also help motivate regular contributions to your investment accounts: when you know why you’re investing and who you’re investing for, choosing to put resources into your investments instead of spending them elsewhere becomes much easier.

If you need help setting S.M.A.R.T. goals, you might consider reaching out to a financial professional like an investment consultant to aid you in the process. Financial advisors and planners like those at Iron Point Financial can help you create a plan that is both flexible and updateable enough to adapt to life’s many changes, and rigid enough to ensure consistent progress towards your main objectives (your ‘roadmap’).

Investment Consulting Strategy #3: Diversification and Asset Allocation

For many beginners, the most intimidating aspect of investing is deciding where to place your money. The foundational concepts of diversification and asset allocation present easy-to-grasp guides for this decision.

Diversification involves spreading your investments across different financial instruments, industries, and markets in order to mitigate the impact of any one security’s decline (if the value of one investment dips, but others are rising elsewhere, you are still winning overall). This strategy can help you manage risk under a variety of market conditions.

Asset allocation is similar in that it also involves diversifying, but in a slightly different way: instead of spreading your investments across different financial instruments and industries, it is about dividing your investment portfolio among different asset types, such as stocks, bonds, and cash. Asset allocation, like diversification, therefore, can help you to optimise your risk-reward ratio in line with your risk profile and the time horizon set as part of your S.M.A.R.T. goals.

Investment Consulting: Diversify or Concentrate?

In theory, a well-diversified investment strategy with good asset allocation can offer better returns over the long-run than a concentrated investment approach (focusing your investments on one or two markets or stocks only), as the former approach comes with less overall risk.

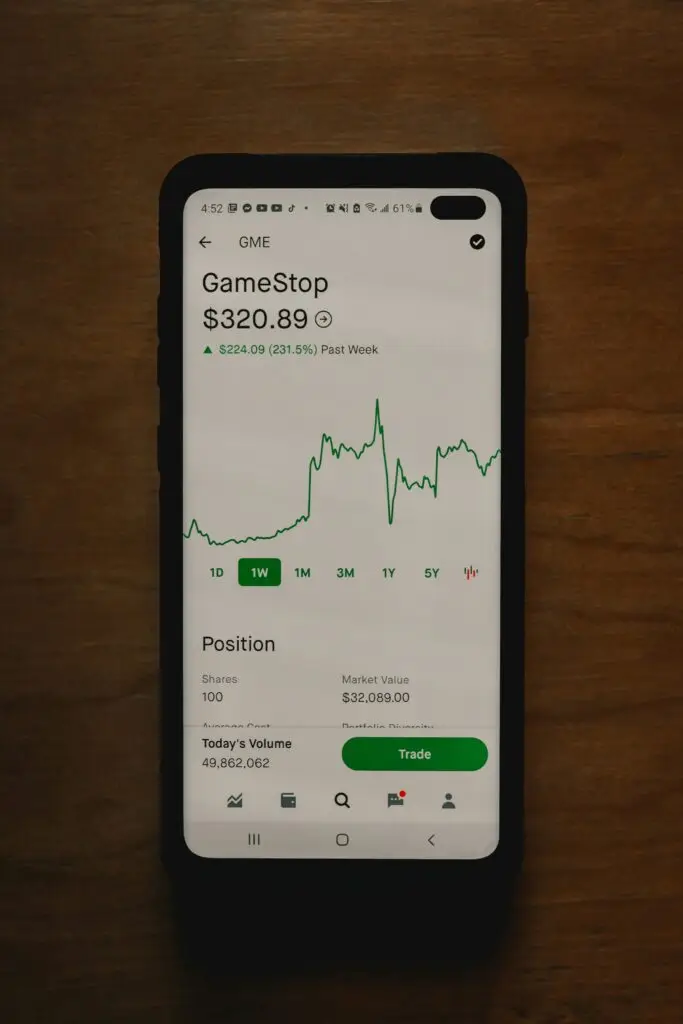

It’s possible that you might see greater success with a concentrated approach in the short-term — for example as the investment world saw in the recent, popularised frenzy around GameStop stock, against conventional market wisdom — but it’s equally plausible that “putting all your eggs in one basket” can fail spectacularly, at great personal cost; if the financial crises of the last few decades have shown anything, it is that no one company or market is “too big to fail.”

And this is why good diversification and asset allocation could actually allow you to get the best of both worlds. In your individual portfolio, you could choose to include a small sample of promising stocks from the concentrated approach while making sure that their inherent volatility does not scupper your entire, more diverse body of investments.

Practically speaking, this means that riskier stocks should make up only a small proportion of your overall portfolio, such that you benefit from them if they appreciate in value, but you do not suffer too much if they depreciate instead, as your other, more stable investments continue to grow (the majority of your portfolio). In other words, diversification allows you to “hedge your bets.”

Investment Consulting Strategy #4: Research, Research, Research!

Hopefully, we have made risk tolerance, clear financial goals and diversification simple enough that you feel confident to start out on your investment journey. However, we would liken the above strategies to the underground foundations of your “investment building” only. The next crucial component to add on top of these foundations is the “rebar” of the investment world: research.

It goes without saying that investing your hard-earned financial resources is not a decision to be taken lightly. Research, therefore, is what adds gravitas and specificity to your investment profile: it allows you to make wise decisions from a range of possible options (vs. investing on a whim) and, with the depth of knowledge it provides, research can help to ensure that your investment choices align with your specific goals.

Research tells you where to diversify your investments, how to allocate your assets, how to ensure that your investments suit your specific risk tolerance and whether potential investments can serve your S.M.A.R.T. financial goals. In essence, research holds everything else together.

Investment Consulting: Research Resources

But where to start? The internet is teeming with paid and free resources on stock profiles, market trends, and financial information, but there is only so much time in the day to work through them. The idea of sifting through petabytes of data is understandably overwhelming for most people.

Online brokerage firms and investment consultants often offer tools that can simplify the research process and help you analyze potential investments more effectively and efficiently. If you find one such source that you trust and combine it with other data — for example from financial news, earnings reports, and breakdowns of industry trends — you can start to gain a broader view of the opportunities out there.

Even then, however, you might want to reach out to a financial professional — like those at Iron Point Financial — who can sit down with you, gain a clear understanding of your values and needs, and then research on your behalf. If time is an issue, then this could be your best option.

Investment Consulting Strategy #5: Professional Guidance

Healthy, long-term investments by their very nature do not happen overnight or by happenstance; typically, some degree of financial expertise has gone into the investment process. This is why leaning on professionals — anywhere from getting them to research and manage your portfolio for you, to providing just enough advice and practical tools to get you going on your own — is our fifth and final recommended strategy.

Good investment consultants can provide you with personalized investment insights, portfolio optimization, and comprehensive financial planning options. The best advisors out there will work with you to understand your unique circumstances, goals, and risk tolerance, and then ensure that your investment strategy is not only aligned with your objectives but is also dynamic enough to adapt to shifts in the market and your personal life.

When choosing an investment consultant, we recommend considering the following five factors:

- Experience & qualifications

- Specialization (with regard to the mode of your investment)

- Personalized approach

- Transparent communication

- Shared values.

Finding someone who is the right fit for your circumstances and values, and who has the requisite professional accreditation and know-how, can be the difference between a failed investment portfolio and a thriving one.

For more depth on each of the five factors above, why not check out our free resource, “How to Find an Investment Consultant: 5 Things to Look For”?

Final Thoughts

The beginner’s investment journey can feel equal parts thrilling and intimidating. However, with the right investment consulting strategies in place, your road to financial freedom can start to look less and less treacherous.

Once you:

- Understand your risk tolerance,

- Set clear financial goals,

- Embrace diversification and asset allocation,

- Conduct thorough research, and

- Seek professional guidance…

…then you can rest assured knowing that you are in pole position for a long-lasting and successful investment experience.

One final, closing nugget of wisdom is this: remember that investing is a marathon, not a sprint. On your investment “race,” you will need to make regular assessments, adjustments, and informed decisions throughout to ensure a resilient and responsive investment approach.

If you’d like a “running partner” to join you, and maybe even do the heavy lifting for a stretch of the journey, why not reach out to Iron Point Financial today to schedule an appointment, and get your financial future on the right track?

Disclosures:

This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Iron Point to provide information on a topic that may be of interest.

The opinions contained in this material are those of the author, and not a recommendation or solicitation to buy or sell investment products. This information is from sources believed to be reliable, but Cetera Advisor Networks LLC cannot guarantee or represent that it is accurate or complete.